India is more attractive than ever to global retailers. India's economic growth, forecasted at 8 percent GDP in 2006, continues to support the retail industry. The estimated $350 billion retail market is expected to grow 13 percent and the top five retailers account for less than 2 percent of the modern retail market. And with one billion people, it is the second largest population in the world.

There are also fundamental changes underway in India. In early 2006, the government announced that it would allow foreign companies to own up to 51 percent of a single-brand retail company, such as Nike or FCUK. This is a significant break for global retailers and will spark a flurry of investment. Already, companies including Gap, Zara, Timex and United Colors of Benetton have announced plans to enter the market.

However, the relaxed regulations do not extend to companies that sell a variety of brands, such as Wal-Mart and Tesco. Despite the ongoing obstacles, Wal-Mart is eager to open its doors in India and is investigating its options. One possibility would be to open a Sam's Club wholesale business through a joint venture and sell strictly to other retailers. This strategy skirts the issue of not being able to sell directly to consumers and establishes a presence in the local market.

Tesco is planning to enter the market through a partnership with Home Care Retail Mart Pvt Ltd and expects to open 50 stores by 2010.

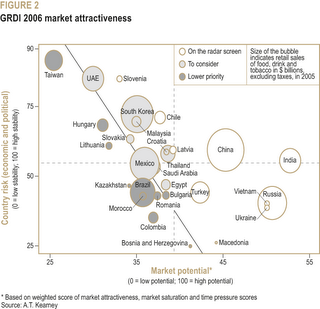

THE 2006 GRDI FINDINGSOn a regional level, Asia reclaimed the lead position from the maturing markets of Eastern Europe. As part of Asia, the Middle East posted the highest retail sales growth globally, led by United Arab Emirates and Saudi Arabia. The Mediterranean held steady with mixed results, while Latin America recovered from its economic crises and enjoyed a strong return on the Index. Finally, Africa remains outside the game, but that is not stopping retailers from entering this populous region. Figure 2 maps out the relative market attractiveness of all countries on the Index. A closer look at each region follows:

Click the image to enlarge.

Asia Reclaims the LeadIn a reversal of the past few years, Asian countries dominate this year's Index and outrank those from Eastern Europe (see figure 3). Asian countries hold 40 percent of the top 20 GRDI markets, while Eastern European countries hold 35 percent. Just last year, Asia accounted for 30 percent while Eastern Europe captured 55 percent. This shift is not a surprise. Asia has always been the largest region of emerging markets: It represents 26 percent of global GDP and 32 percent of global retail sales. Its annual retail sales grew at a healthy rate of 7 percent in 2005. More important, modern retailers have tapped into just 28 percent of the region, compared with 42 percent of the markets in Eastern Europe.

No comments:

Post a Comment